How to Start Investing in Stocks (2025 Edition): The Beginner's Guide for a Smarter Future

Forget boring textbooks. Here's how Gen Z is using AI to learn, invest, and win — without wasting hours on research.

Why 2025 Is the Best Time to Start Investing

Stock investing isn't just for Wall Street anymore. In 2025, more people under 30 are opening investment accounts than ever before, and they're not following old-school playbooks.

What's changed?

-

📱 Mobile apps have made trading accessible

-

🧠 AI tools like Stratman AI simplify stock research

-

💬 Financial advice is now found on X, Reddit, and TikTok

But while access has increased, clarity hasn't. Many beginners still feel lost in charts, jargon, and conflicting advice.

So here's your simple roadmap to start investing the right way — without getting overwhelmed.

Step 1: Understand What "Investing" Really Means

Investing means putting money into assets that grow over time — like stocks, ETFs, or even dividend-paying companies. It's how people build long-term wealth.

Unlike saving, investing isn't about safety — it's about growth.

🧠 Pro Tip:

$5/day invested in a simple index fund from age 20 could grow to over $700,000 by retirement (assuming 8% average return).

Step 2: Choose the Right Investing Platform

If you're between 16–28, you're likely using or considering apps like:

-

💸 Robinhood

-

💼 Fidelity

-

📊 Charles Schwab

-

🧠 AI-first tools like Stratman AI

Old approach: Open a brokerage, Google every stock, drown in spreadsheets.

2025 approach: Use an AI copilot to answer questions instantly and guide your decisions.

With Stratman AI, beginners can:

-

Ask questions like "Should I buy $TSLA?"

-

Instantly understand financials with hotkeys like

$AAPL f -

Compare stocks, track dividends, and view trends — no jargon

Step 3: Learn the Core Terms (Without Getting Bored)

Here's what you need to know — in plain English:

| Term | What It Really Means | | ----- | ----- | | Stock | A tiny piece of a company you can own | | ETF | A basket of stocks (like a playlist) | | Dividend | Company pays you a small amount regularly for holding stock | | P/E Ratio | A measure of how "expensive" a stock is | | Volatility | How much a stock price jumps around |

Stratman AI explains every metric in real-time — no need to Google anything.

Step 4: Avoid These Beginner Mistakes

🚫 Following hype without research

🚫 Panic-selling when stocks dip

🚫 Ignoring fees and taxes

🚫 Overinvesting in one stock or crypto

✅ What to Do Instead:

-

Start with index funds or strong blue-chip stocks

-

Set long-term goals (don't chase quick flips)

-

Use tools like Stratman AI to stay objective and informed

Step 5: Ask Questions, Get Answers — Instantly

Instead of watching 5 YouTube videos and reading Reddit threads…

💬 Ask Stratman AI:

-

"Compare $MSFT vs $GOOGL"

-

"Show me stocks that pay monthly dividends"

-

"Explain P/E ratio for $NVDA"

Everything is visual, real-time, and designed for beginners.

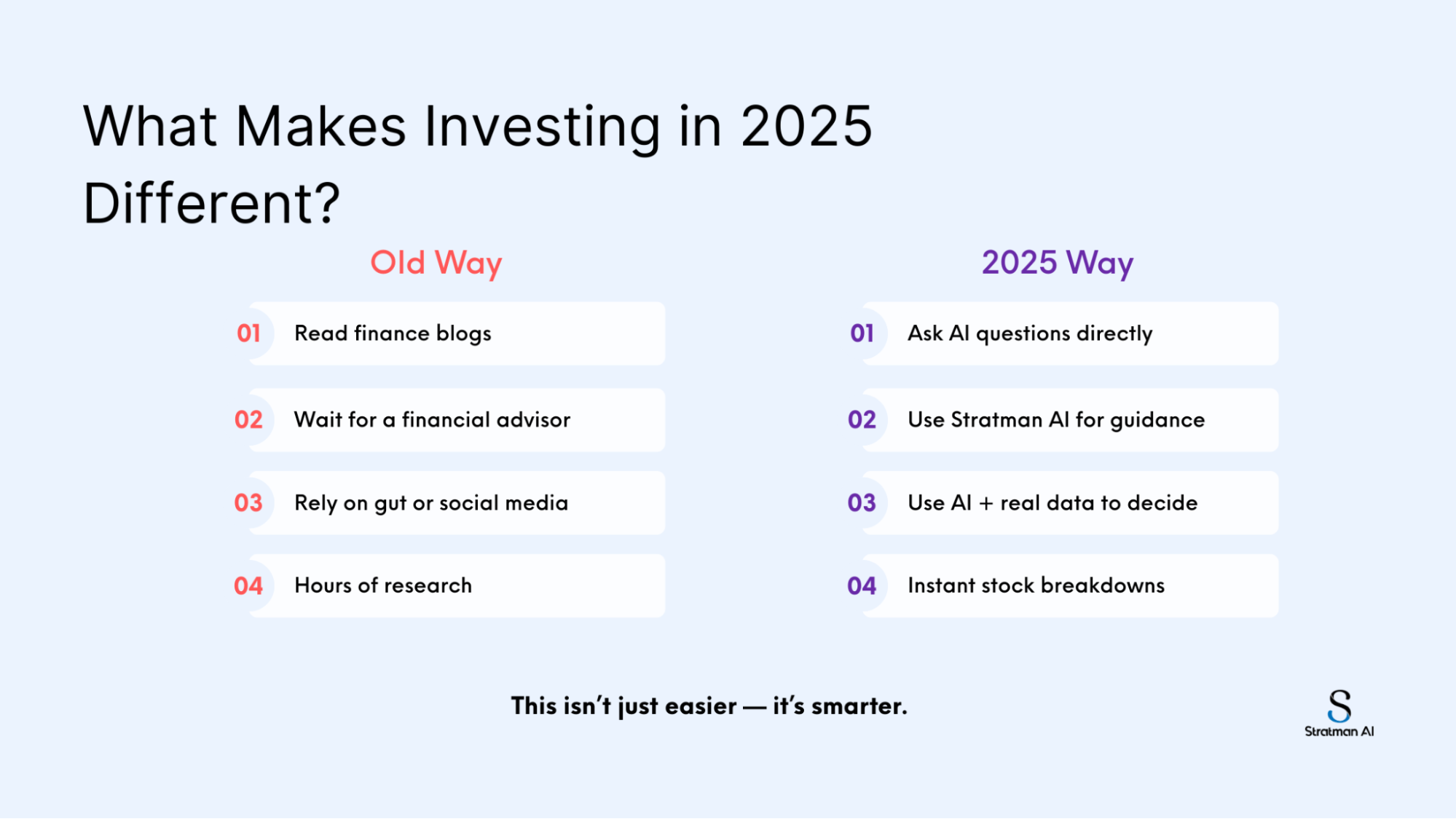

What Makes Investing in 2025 Different?

Here's what makes this generation of investors unstoppable:

| Old Way | 2025 Way | | ----- | ----- | | Read finance blogs | Ask AI questions directly | | Wait for a financial advisor | Use Stratman AI for guidance | | Rely on gut or social media | Use AI + real data to decide | | Hours of research | Instant stock breakdowns |

This isn't just easier — it's smarter.

Try Stratman AI Free — No Card Required

🔍 Want to know if $AAPL is a smart buy right now?

📈 Need to compare $TSLA to $RIVN fast?

💬 Struggling to understand finance terms?

You don't need a degree. You just need better tools.

👉 Try Stratman AI Free Now

👉 See How Stratman Explains Any Stock Instantly

Final Thoughts: Your Investing Future Starts Now

The best investors of the next decade will be the ones who:

-

Start early

-

Stay consistent

-

Use AI to learn faster and act smarter

Don't wait for a "perfect time."

Your journey to financial freedom starts with your first smart question.

Ask Stratman AI anything.

Invest with confidence.

Build wealth your way.

How to Invest with Little Money (2025 Edition): 7 Smart Tips for Beginners

You don't need thousands to start. Here's how Gen Z is investing with $10, $50, or $100 — and getting smarter with AI.

Why You Don't Need to Be Rich to Invest

In 2025, the best investors aren't the wealthiest — they're the smartest. Thanks to AI tools and fractional investing, you can start building wealth with as little as $5–$50.

Forget the myth that you need thousands of dollars. You just need the right strategy, tools, and mindset.

1. Start With What You Have — Even If It's $10

You can now invest in fractional shares, meaning you don't have to buy a full $TSLA or $AAPL share to get started.

-

💡 Have $20? You can still own a piece of Amazon.

-

📱 Apps like Robinhood or Fidelity make it easy.

-

⚡ Stratman AI helps you decide what to buy — even if you're only putting in $10.

-

⚡ Stratman AI helps you decide what to buy — even if you’re only putting in $10.

“How much you invest doesn’t matter as much as how early and often you invest.”

2. Set a Monthly Micro-Investment Habit

Consistency beats size. Even $25/month compounds fast when you stay consistent.

| Monthly Investment | 30 Years Later (8% Avg Return) | | ----- | ----- | | $25/month | $35,000+ | | $50/month | $70,000+ |

Set auto-transfers and let your money grow.

🔁 Pro Tip: Automate your investing to remove emotion.

3. Use Stratman AI to Find Smart, Beginner-Friendly Investments

No clue where to start? Ask Stratman AI:

-

“What are good low-risk stocks in 2025?”

-

“Should I buy $SPY or $QQQ?”

-

“Compare $AAPL vs $MSFT in plain English”

✅ See dividend payouts

✅ Understand risk and volatility

✅ Instantly compare stocks with no jargon

📣 Try Stratman AI Free – No Card Required

4. Start With ETFs (Your Diversified Shortcut)

Don’t put your $50 into just one company.

ETFs (exchange-traded funds) are like stock playlists — they give you access to dozens or even hundreds of companies in one buy.

Top beginner picks:

-

$SPY – S&P 500

-

$VTI – Total U.S. Market

-

$QQQ – Top tech stocks

Stratman AI breaks down ETFs instantly:

💬 “Show me top holdings in $QQQ” → You’ll get a clean, visual answer.

5. Reinvest Dividends (Don’t Cash Out Early)

When you get dividend payouts, reinvest them automatically.

That’s how you compound:

-

$2 becomes $2.10

-

$2.10 becomes $2.25

-

Over time, it snowballs into thousands

📊 Stratman AI shows dividend charts & payout history — super helpful when picking income-generating stocks.

6. Avoid High Fees, Fancy Advisors & TikTok FOMO

🚫 Avoid:

-

Overhyped “stock picks” on TikTok

-

High-fee mutual funds

-

Day trading with no plan

✅ Instead:

-

Stick to low-fee ETFs

-

Learn with real data

-

Use AI tools like Stratman to make smarter calls

7. Ask Questions Before You Invest (Stratman Can Help)

Before you invest even $20, ask:

-

“What does this company do?”

-

“How has it performed over time?”

-

“Is it growing, profitable, or paying dividends?”

With Stratman AI, you don’t need to Google 10 articles or watch 5 YouTube videos.

💬 Just type your question — get instant answers in plain English.

📌 Try Stratman AI Free Today

Final Thoughts: Small Steps → Big Future

You don’t need to wait until you’re “ready.”

You don’t need thousands to begin.

You need a few dollars, a smart plan, and better tools.

The earlier you start, the more time your money has to grow.

✅ Build your habit

✅ Ask smarter questions

✅ Let Stratman AI help you level up

Instant Investing Help (CTA)

📉 Lost in stock research?

📈 Want to understand $AAPL in one click?

👉 Ask Stratman AI Anything — For Free

👉 Start Investing Smarter (No Card Needed)